𝐎𝐯𝐞𝐫𝐚𝐥𝐥 𝐚𝐜𝐭𝐮𝐚𝐥 𝐬𝐨𝐟𝐭𝐰𝐨𝐨𝐝 𝐭𝐢𝐦𝐛𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐟𝐥𝐞𝐜𝐭𝐢𝐨𝐧 (𝐢𝐧𝐬𝐩𝐢𝐫𝐞𝐝 𝐛𝐲 𝐏𝐌𝐈 𝐨𝐮𝐭𝐜𝐨𝐦𝐞 𝐀𝐩𝐫𝐢𝐥)

𝑷𝑴𝑰:

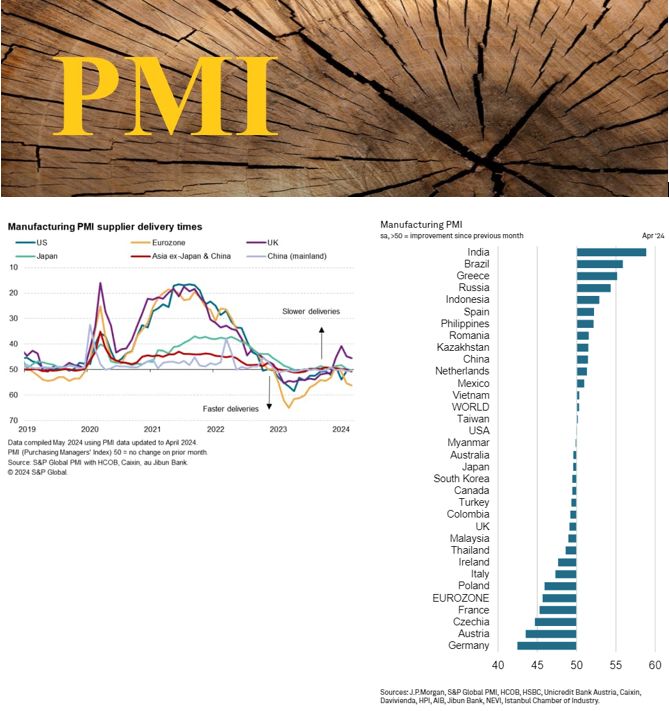

Let’s start with some positive news regarding the April publications of the PMI figures. The Dutch PMI rose from 49.7 to 51.3. For the first time since August 2022, indicating an improvement in business conditions! Production, the number of new orders, and employment are all increasing at a faster pace.

The Eurozone continues to display a mixed set of economic indicators. The traditional powerhouse, Germany, continues to contract. Italian production activity shrank again last month, while French PMI declined due to weaker production and demand. But, German PMI did move slightly closer to the break-even point (from 41.9 > 42.5). Although German manufacturers expressed more confidence in the coming year, overall optimism remains relatively low compared to historical norms.

Global production increased for the fourth consecutive month, although growth slowed slightly (50.6 > 50.3). The decline in the new order index is mildly concerning, but the employment index showed stability. Europe and Asia seem to be slowly closing the gap to growth, although a sharp global industry recovery still seems unlikely at this time.

𝑻𝒊𝒎𝒃𝒆𝒓:

Driven by the lagging industrial growth in the domestic market, the German sawmill industry continues to lag behind their Scandinavian counterparts, who partly managed to alleviate cost pressures through price increases despite the still weak demand in the timber market. Inventory levels in the wood processing industry seem to have increased somewhat due to buyers’ response to recent supply chain problems from northern Europe. Now that these problems have been resolved, there is fear of more supply being offered, although this effect is not yet visible.

If transport problems, resulting in significant price increases, from Eastern Europe were also resolved, this could lead to more supply. That said, I see no chance of a significant price drop. Driven by heavy cost pressures, the sawmill sector cannot afford falling selling prices.

Currently, the timber market is in a kind of status quo position that hardly moves visibly. However, demand remains the concern here. Consumer confidence has risen, particularly in Europe, while sentiment in the Asia-Pacific and Latin America regions is mixed.

Despite the typically low activity of the “holiday month of May,” the most active spring quarter generally brings a bit more sunshine to the production landscape. Let’s all use the Dutch production PMI as a guideline in this 😊; let’s go for it!

https://www.linkedin.com/posts/driessenrob_pmi-softwood-timber-activity-7193606227019321345-SqRf?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAmPJtABFEvzNsnxg0aKqOaxqF0Dc9DGFSw