𝗢𝘃𝗲𝗿𝗮𝗹𝗹 𝗮𝗰𝘁𝘂𝗮𝗹 𝘀𝗼𝗳𝘁𝘄𝗼𝗼𝗱 𝘁𝗶𝗺𝗯𝗲𝗿 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝗳𝗹𝗲𝗰𝘁𝗶𝗼𝗻 (𝗶𝗻𝘀𝗽𝗶𝗿𝗲𝗱 𝗯𝘆 𝗣𝗠𝗜 𝗼𝘂𝘁𝗰𝗼𝗺𝗲 𝗠𝗮𝘆)

𝗣𝗠𝗜:

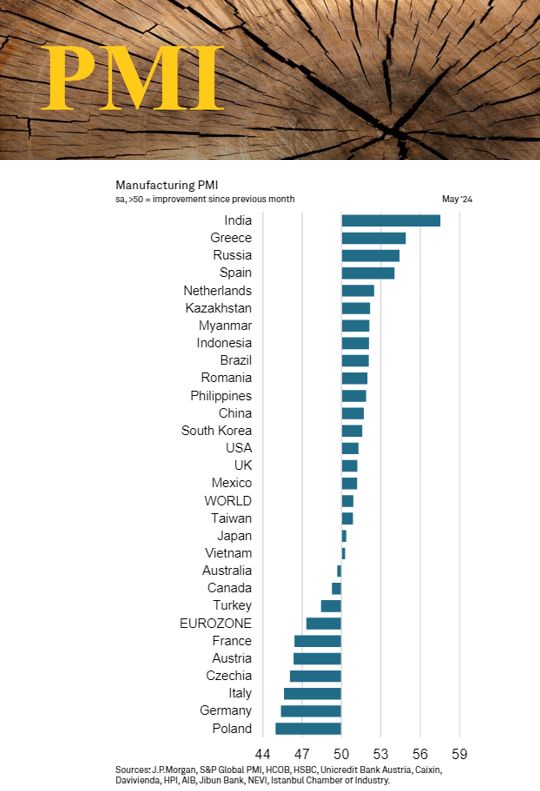

There is overall optimism in the manufacturing industries! Virtually all May figures are on the rise. Even the beleaguered German manufacturing sector is experiencing a real upturn after 12 months of continuous decline.

The main conclusions from the summary global manufacturing PMI figures for May are:

· In May, the global PMI reached its highest point in 22 months at 50.9. Gains in new orders and employment PMIs indicate a future upturn.

· Inflationary pressure remained high and showed further signs of persistence. This appears to have had no impact on business confidence so far, which is overall positive and rose to one of the highest levels of the past year.

Despite this inflationary pressure, the ECB lowered its interest rate for the first time since September 2019 by 0.25%.

· Price pressures continue to rise.

China, the US, India, and Brazil were among the larger countries benefiting from improved global trade flows.

In the UK, PMI figures are rising at the fastest pace since early 2022. The “breadth positioning of this recovery” is particularly positive.

In the Eurozone, sentiment seems to have reached a turning point where the production decline appears to have been halted. Optimism is growing, but companies remain cautious. They continue to downsize their workforce and lag in purchasing intermediate goods (such as timber).

𝗧𝗶𝗺𝗯𝗲𝗿:

We see distinct movements in the timber market. The beforementioned (general) cost pressure on sawmills continues to increase (including anticipated roundwood price hikes).

While demand was rising in the first 3-4 months of this year due to various previously mentioned causes, we now see clear stabilization. This is largely due to the removal of some of these supply blockages.

However, demand is increasing, albeit modestly, with the packaging industry leading the way.

The steps the market is taking so far are modest, which means the differences are not apparent.

If this positive demand curve in the industry becomes evident in the timber market, the imbalance will become visible. There is no oversupply. Demand has been driving the market for two years. That’s why we for instance have not noticed the absence of Russian and Belarusian supplies during this period…

Center timber will remain in the waiting room a bit longer. However, as said, where demand rules an invigorating manufacturing industry will definitely impact our timber market (…sooner than later 😊)!

https://www.linkedin.com/posts/driessenrob_softwood-timber-pallets-activity-7204787410247794689-kFf9?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAmPJtABFEvzNsnxg0aKqOaxqF0Dc9DGFSw