𝐎𝐯𝐞𝐫𝐚𝐥𝐥 𝐚𝐜𝐭𝐮𝐚𝐥 𝐬𝐨𝐟𝐭𝐰𝐨𝐨𝐝 𝐭𝐢𝐦𝐛𝐞𝐫 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐟𝐥𝐞𝐜𝐭𝐢𝐨𝐧 (𝐢𝐧𝐬𝐩𝐢𝐫𝐞𝐝 𝐛𝐲 𝐏𝐌𝐈 𝐨𝐮𝐭𝐜𝐨𝐦𝐞 𝐀𝐩𝐫𝐢𝐥)

𝗣𝗠𝗜:

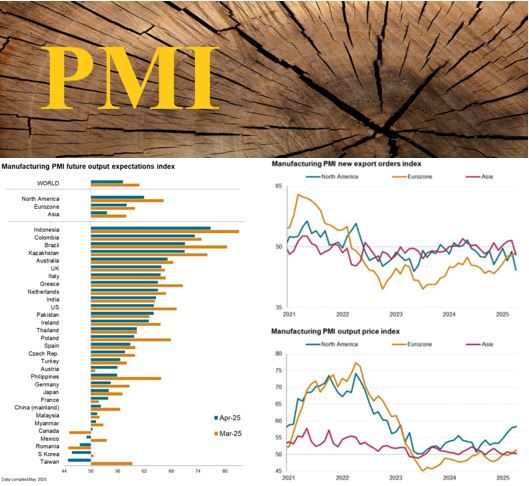

Global manufacturing conditions deteriorated slightly for the first time this year, falling to 49.8

Positive momentum came from Indian exports, which grew at the second-fastest pace in over 14 years, and German exports, which increased for the first time in more than three years.

Three key reasons for the overall Global decline: Global export orders – Future production expectations – Inflation

Notably, prices in the US rose at their fastest pace since early 2023, while Asian prices remained almost flat and the Eurozone saw only a modest increase. The short-term inflationary impact of tariffs is primarily being felt in North America (see chart).

Combined export orders from North American and Asian manufacturers fell at the fastest rate in over 20 months. In contrast, eurozone exports showed the smallest decline in three years.

The near-stabilization of the eurozone’s industrial economy was supported by a rise in production in both Germany and France in April, with Italy also clawing its way back into expansion territory. However, this trend is unlikely to continue, as U.S. tariff policy will likely lead to increased inflows of Chinese goods into the EU.

Only six economies reported an improved outlook for the year ahead (mainly Canada. See chart).

Concerning trends in trade, inflation, and business confidence persist. Tariffs, trade protectionism, and global uncertainty continue placing significant pressure on the world economy.

𝗧𝗶𝗺𝗯𝗲𝗿:

Timber prices have stabilized. Whether there’s actually more timber available is doubtful — demand has simply dipped. After a modest increase in Q1, the momentum has completely stalled, further impacted by the spring holidays. Where sawmills had previously faced backlogs, they are now gradually catching up.

Cost pressures remain despite a drop in energy prices.

Even though market sentiment is negative due to weak demand, this is unlikely to impact sawmill utilization before summer. With the summer shutdown approaching, there’s no sign of any oversupply — even if weak demand continues. And certainly not with the current favorable tariff conditions… though one never knows.

On the other hand, a wood shortage is also not expected.

The ball is in the court of ‘demand’: Europe is showing signs of recovery, but a truly revitalized, more EU-oriented manufacturing sector is not likely to reveal its full potential before 2026.

Until then, it’s still a matter of “biting the bullet” — or perhaps better said, “chewing on a wooden stick” ☺️

https://www.linkedin.com/posts/driessenrob_softwood-timber-pallets-activity-7325904032537993216-qNSs?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAmPJtABFEvzNsnxg0aKqOaxqF0Dc9DGFSw