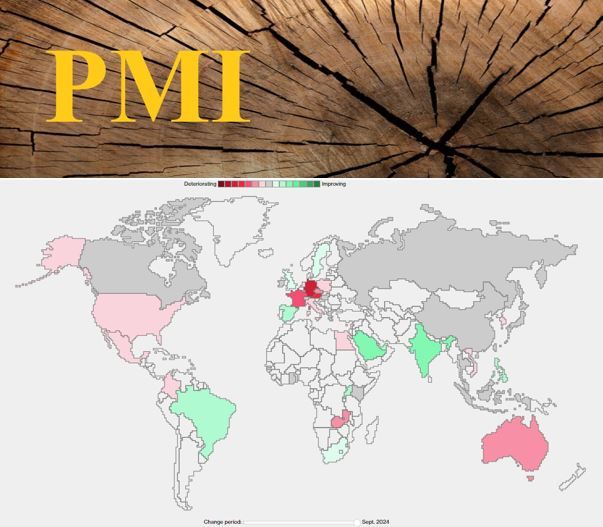

𝗢𝘃𝗲𝗿𝗮𝗹𝗹 𝗮𝗰𝘁𝘂𝗮𝗹 𝘀𝗼𝗳𝘁𝘄𝗼𝗼𝗱 𝘁𝗶𝗺𝗯𝗲𝗿 𝗺𝗮𝗿𝗸𝗲𝘁 𝗿𝗲𝗳𝗹𝗲𝗰𝘁𝗶𝗼𝗻 (𝗶𝗻𝘀𝗽𝗶𝗿𝗲𝗱 𝗯𝘆 𝗣𝗠𝗜 𝗼𝘂𝘁𝗰𝗼𝗺𝗲 𝗦𝗲𝗽𝘁𝗲𝗺𝗯𝗲𝗿)

𝗣𝗠𝗜:

The manufacturing sector continues to struggle with market challenges. With a fourth consecutive decline in the global Manufacturing PMI (48.8), a stagnating Chinese industry, and the Eurozone finishing below 50 for the 27th time (45) at its lowest point in 2024, there is no turnaround in sight. However, it should be noted that the overall economic situation still shows growth, even in the Eurozone.

If only the Spanish market could offset the German downturn. This industrial powerhouse continues to falter and grapples with recession fears. Nearly 40% of German manufacturers are considering scaling back or relocating production. With the pain from the energy crisis, geopolitical tensions, and an auto industry completely off track, the challenges are immense.

With industrial challenges abound. Now, a look at our own (wood) manufacturing industry.

𝗧𝗶𝗺𝗯𝗲𝗿:

Why would it be any better in “our market”? As has often been noted, the wooden pallet and packaging industry is the barometer of the entire manufacturing sector, and we therefore feel every challenge more intensely than anyone else. We are interconnected…though this rarely leads to an understanding relationship 😉

Understanding for the wood industry (sawmills) remains largely limited to a “as long as the price is right” mindset. And to cross that metaphorical bridge, “the price is no longer right.” In the background, problems are mounting. Cost pressure, specific raw material requirements failing, and labor availability play a crucial role here. Market prices have long ceased to suffice in handling this cost pressure, and the “Covid reserves” have evaporated.

Log prices are rising in all wood regions, and infected logs are no longer available. Moreover, the desired log diameters are no longer as readily available as needed.

If the demand side were not so weak, we would now be facing a full-blown availability crisis. This is also why price pressure is mounting cautiously on the sales side. Certain wood dimensions are already sold out through the end of the year. When are they lacking..? It is clear that the demand side will not drive any change in 2024. The shortage of one or more sizes will be the first moment of price increase. It seems highly likely that we will experience this before year’s end.

https://www.linkedin.com/posts/driessenrob_softwood-timber-pallets-activity-7249341464441237504-ScX5?utm_source=share&utm_medium=member_desktop&rcm=ACoAAAmPJtABFEvzNsnxg0aKqOaxqF0Dc9DGFSw

nl

nl